Facing the tough decision to shut down your startup is challenging enough, but navigating potential legal minefields during the process can be even more daunting.

From employment laws to financial obligations, the path to a clean and litigation-free shutdown is fraught with pitfalls.

This guide will arm you with essential strategies to minimize legal risks and shut down your startup gracefully.

1. Handle Employee Layoffs and Severance the Right Way

Laying off employees must be done with care and consideration. Not least because it cushions the blow but also because you don’t want to end up on the wrong side of the law.

As a startup, it’s unlikely that your company has more than 100 employees. But if it does, you’ll need to give them a 60-day notice period, as mandated by the federal Worker Adjustment and Retraining Notification (WARN) act. This should be your starting point.

Then, to further reduce the likelihood of facing litigious actions from your employees:

Be respectful, empathetic, and transparent. Break the news as soon as possible to give your employees enough time to plan their next move.

Handing out severance is not obligatory unless you stated or implied otherwise. Still, if company finances allow, provide packages based on seniority and length of service.

If you cannot offer financial assistance, extend help in other ways. These include providing access to job boards, interview training, and helping employees polish and update their resumes.

Note: Even if you don’t qualify for the WARN act, we strongly recommend reading up on state-specific requirements related to employee layoff conditions and notification periods.

2. Settle Contracts and Clear Debts

Before winding down your startup, you must resolve all contracts and outstanding debts, which can be tricky if it’s your first time closing a business.

Start with bringing your clients up to speed regarding the imminent shutdown and try to complete ongoing projects with minimal disruptions. If that doesn’t work, see if you can transfer it to another company willing to take on the project.

As far as debts are concerned, your negotiation skills will matter a lot. Reach out to your creditors and explain your financial situation. The best case scenario is when creditors agree to negotiate the settlement (this usually happens when they feel that pursuing the total amount will take too much time or resources on their end).

Others might agree to debt repayment plans where they agree to extend the repayment period or reduce the monthly payment amount. If you’re in a situation where none of this is possible, then bankruptcy could be on the cards, which generally involves the sale of all assets (digital and otherwise) to pay off creditors.

3. Legally Dissolve The Startup

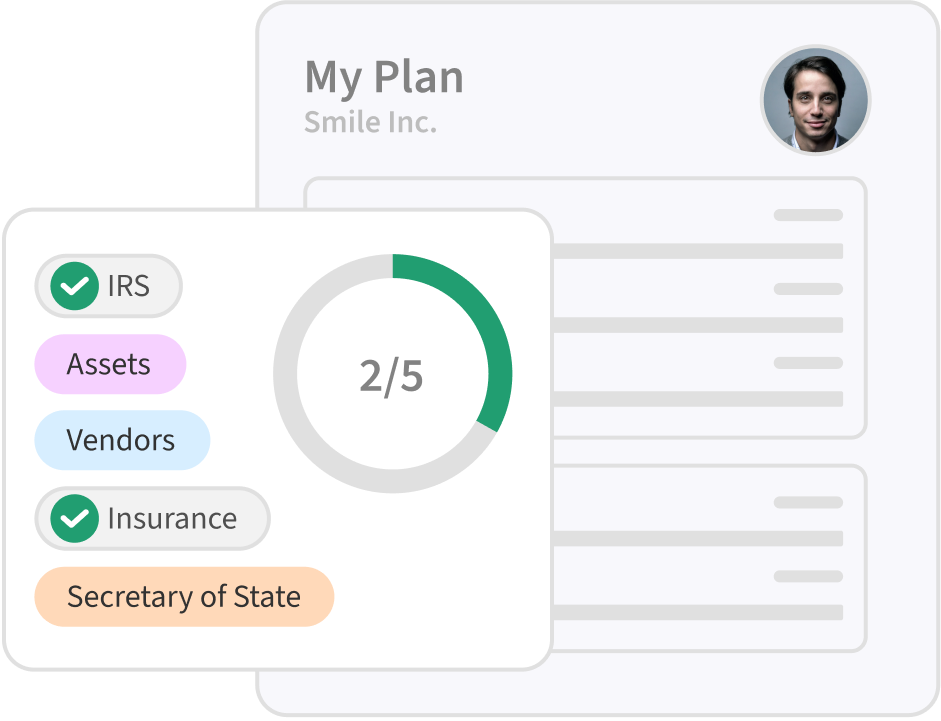

Startup dissolution is a multi-step process that varies depending on the state where you incorporated your company. Throughout the previous steps, we discussed the possible litigation threat from stakeholders. Here, we’ll discuss how to avoid the wrath of government-related agencies by shutting down in a legally-sound way.

Disclaimer: This section deserves an article by itself, which is why you should check out our closing down a startup checklist blog for a complete read. That said, here’s a quick run-through on how to dissolve a startup business entity:

The startup owners or board of directors must agree via a majority vote to close the company. According to some states, you’re required to document the entire process. The specifics of the company shutdown will depend mainly on its structure (sole proprietorship, partnership, LLC, S Corp, or C Corp) and the terms contained within the Founding documents.

File the dissolution documents (commonly called the Articles of Dissolution) with the secretary of state or an equivalent government agency.

Notify the IRS about the closure, fulfill your remaining tax obligations, and submit the required tax forms.

Cancel all permits and licenses, e.g. industry-specific licenses and state sales tax permits.

4. Stick to Industry Specific Rules and Regulations

Continuing on from the last point, there are additional legal requirements that you may or may not need to follow depending on the industry.

For example, tech startups incorporated in California must follow the California Consumer Privacy Act (CCPA), which involves securely transferring, anonymizing, or destroying user data. It also informs users how their data will be handled as the startup prepares to shut down.

Another law known as the Health Insurance Portability and Accountability Act (HIPAA) applies to healthcare startups, instructing them on safeguarding and disposing of sensitive data. Unlike CCPA, HIPAA is a federal law and applies nationwide.

Failing to comply with both laws can result in heavy penalties and fines, the consequences of which extend beyond the financial realm, i.e., reputational damages that make it increasingly difficult to secure investor funding in the future.

5. Keep VCs and Investors in the Loop

The last point is to revisit the terms of agreement with your investors and VCs. Oftentimes, these documents contain clauses related to company management, funds utilization, and the modality of company sale or dissolution.

Although uncommon, non-compliance with one or more clauses can lead to potential litigation – it’s better to be safe than sorry.

Secondly, maintaining open lines of communication with investors is paramount, but as you approach the start of the dissolution process, this approach becomes more critical than ever. To prevent misunderstandings or possible disputes during this challenging stage, provide routine updates regarding the previously discussed points.

Conclusion

Navigating your startup's closure with minimal legal risk isn't just about adhering to regulations; it's about ensuring peace of mind and paving the way for future endeavors.

While the journey may seem complex, armed with the right strategies and support, you can achieve a smooth and dignified closure.

At SimpleClosure, we specialize in streamlining this process using innovative AI and legal tech, offering a cost-effective and legally sound path to closure.

Connect with us and take your first step towards a hassle-free shutdown.