Deciding to close your startup is a tough call, and doing it the right way is essential. You might wonder, can you just walk away? Technically, yes, but that can lead to unforeseen problems.

Every year, numerous entrepreneurs decide to exit their startup businesses hastily. Despite potentially receiving venture capital funding, these startups often leave behind a trail of financial obligations. Taxes go unpaid, registered company agents resign, and Secretary of State filings are neglected. Over time, these oversights can escalate into serious legal and financial consequences for the founders, who may not be fully aware of the implications.

Therefore, even though leaving your company might seem straightforward, it's rarely a prudent decision. This blog aims to shed light on the common mistakes made during startup closures, using real-world examples to illustrate the risks of an inadequate shutdown process.

6 Startup Business Closure Mistakes

1. Not Following Legal Protocols

In each U.S. state, specific legal requirements dictate the proper procedure for closing a startup. This typically involves submitting necessary paperwork and resolving outstanding liabilities. Neglecting this crucial dissolution process means the company technically remains in existence, leaving the founders legally and financially accountable for ongoing obligations such as annual report fees and state tax filings.

Real-world example:

RadioShack was a popular American electronics retailer that filed for Chapter 11 bankruptcy in 2015. The decision came after years of unprofitability and mounting debts. However, one big mistake the company made was its decision to include its customers’ sensitive information as part of the asset sale.

Because the company was willing to sell the personal data of millions of people, the move would potentially violate customer protection laws and the company’s own privacy policy. RadioShack got into multiple legal disputes, which prolonged the bankruptcy process and significantly damaged its reputation.

2. Ignoring Tax Obligations

Settling all tax liabilities with the relevant federal, state, and local tax agencies is essential. The process usually involves filing final tax returns, paying outstanding taxes, and filling out specific tax-related forms.

Ignoring these obligations might cause the tax authorities to pursue startup owners and hold them personally responsible for unpaid taxes, along with additional penalties.

Real-world example:

Borders Group Inc., once the second-largest bookstore chain in America, filed for bankruptcy in 2011 due to increased competition and an inability to adapt to changes in the marketplace. The company hoped to find a buyer, restructure, and come back stronger.

However, failing to achieve that goal, it began liquidating its assets. Problems soon arose after several states – including the State of Michigan – claimed millions in unpaid taxes. The company's unresolved tax liabilities complicated the bankruptcy process, adding further administrative burden and delaying the asset distribution.

3. Overlooking Outstanding Debts

It goes without saying that a closing startup business needs to notify its creditors about the imminent shutdown and make arrangements to pay its debts. This generally involves selling assets along with negotiating better terms with creditors.

Should a company fail to address its debt situation properly, these creditors can take it to court – and possibly the owners – if it’s found that the proper dissolution procedures weren’t followed. At a time when funds are limited, legal battles are the last thing startup founders need.

Real-world example:

The iconic U.S. toy retailer Toys "R" Us filed for bankruptcy due to unending financial troubles and a spike in competition. It was $5 billion in debt, and despite efforts to restructure and make a comeback, it was forced to liquidate all of its assets to cover its liabilities.

The company was embroiled in numerous legal battles with vendors and creditors to whom they owed millions of dollars. Not only that but thousands of workers also lost their jobs in the process. Looking back, the company could and should have implemented better financial management practices to pay off its debt.

Although Toys “R” Us was a huge company, its case is still relevant to startups, perhaps even more so, as smaller company owners like sole proprietors and partnerships have greater personal liability.

4. Neglecting Employee Rights

In many jurisdictions, local labor laws require companies to hand out final paychecks to employees within a certain period and/or require advance notice in case of mass layoffs (as stipulated by the U.S. WARN Act).

While there's no federal law mandating startup businesses to hand out severance packages, it's standard practice in some industries and might be required if, at any point, you indicated to your employees that they would receive financial compensation post-shutdown or if it was part of their contract.

Real-world example:

American Apparel's 2016 bankruptcy and subsequent layoffs serve as a good example. Its employees claimed they needed to be given more time to prepare for the shutdown and handed their final paychecks. This oversight, whether intentional or not, triggered massive protests and legal action against the company.

This situation stresses the importance of knowing and upholding employee rights. Even if the startup goes under, the owners' reputation can be significantly damaged, which might result in them being unable to secure investor funding, recruit top talent, or do any business in the future.

5. Poor Asset Management and Distribution

A soon-to-shut-down startup should distribute its assets to stakeholders according to their status and interests in the company. That, too, should be done only after settling outstanding debts and liabilities. Selling assets too quickly, below the current market value, or disproportionately (favoring some over others) raises suspicion and creates legal challenges, as the following example illustrates.

Real-world example:

The downfall of Dewey & LeBoeuf in 2012 was one of the largest law firm collapses in history. The case was marked by allegations against the firm's leaders, accusing them of paying themselves high salaries and bonuses even as the firm was under heavy debt and bankruptcy was on the cards.

Whatever scarce resources and assets the firm had were used in a way that was illegal, unethical, and financially irresponsible. Naturally, criminal charges were filed against the firm's leaders, followed by lengthy legal battles.

6. Mishandling Intellectual Property (IP)

A surprising number of startup owners underestimate the value of their Intellectual property (IP). IP is more than just a company logo; it includes patents that protect years of innovative R&D, trademarks that guard brand identity, and valuable trade secrets that give a company its competitive edge.

Mishandling IP (and even abandoning it sometimes) can cause startups to miss out on massive paydays. Company owners should ideally decide how to handle their IP during formation.

Apart from the potential monetary benefits, Not taking proper care of IP can result in it getting lost or stolen or the company getting involved in legal disputes surrounding infringement and ownership.

Real-world example:

Nortel Networks, at one time a telecommunications giant, provides a notable example. After declaring bankruptcy in 2009, Nortel had to liquidate its assets, including a vast and valuable portfolio of patents. However, the process was not straightforward. The mishandling of these assets became evident when it took over two years to auction its IP portfolio, which included around 6,000 patents and patent applications.

The delay in the sale and the complexity of the IP portfolio led to legal battles among potential buyers and creditors. Although the patents eventually sold for $4.5 billion in 2011, the prolonged process complicated the liquidation, incurred additional costs, and delayed the distribution of assets to creditors. This case highlights the importance of a well-planned and timely approach to handling IP during the shutdown process.

Conclusion

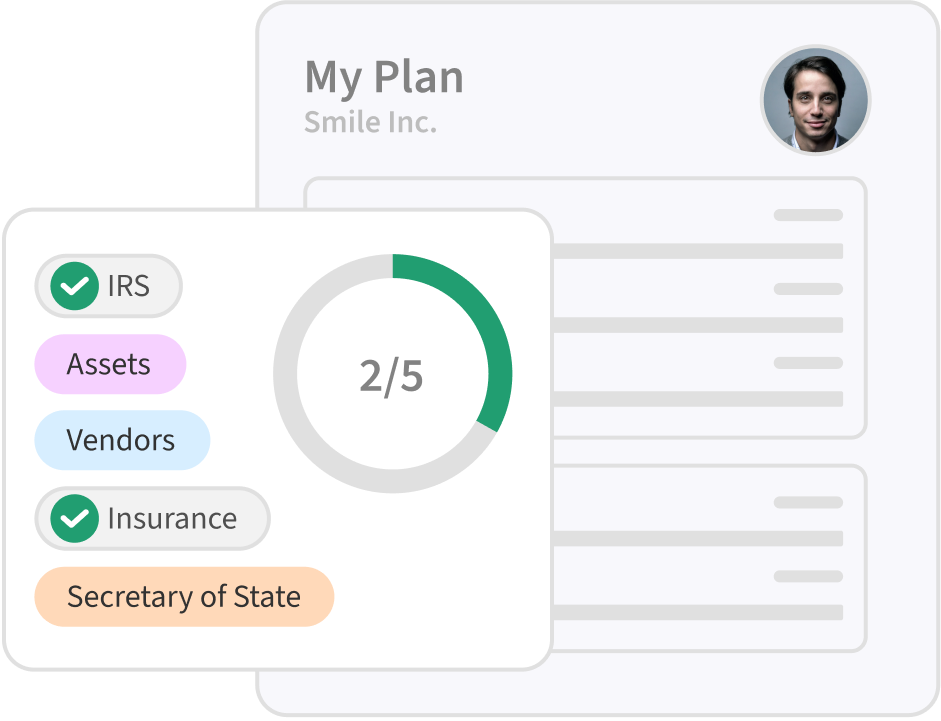

Avoiding these six pitfalls is just the beginning of a responsible startup closure. For a comprehensive guide on shutting down correctly, explore our detailed checklist.

Understanding the complexities of closing a startup can be challenging. And if the decision to shut down your startup is final, why not save tons of time and money? At SimpleClosure, we specialize in guiding entrepreneurs through this process seamlessly and legally. Contact us to explore efficient and cost-effective closure strategies.