Crisis management involves identifying, assessing, and dealing with significant threats to a business's ongoing concern. For startups – which often have limited free resources and face high uncertainty – having an effective crisis management plan is essential in overcoming unexpected challenges and ensuring survival.

In this blog, you’ll learn about the types of crises you could potentially face, how to recognize their early signs, and how to create an effective crisis mitigation plan. By the end, you'll have practical insights to help protect your startup and bounce back from any unexpected disruptions.

Common Types of Crisis Startups Usually Face

1. Financial

Startups can face financial crises due to cash flow problems, unexpected expenses, or funding issues. As financial pressures escalate, maintaining steady revenues becomes a real and constant struggle.

Example:

Greensill Capital, a financial services startup specializing in supply chain financing, faced a severe financial crisis in 2021. The company collapsed after losing its insurance coverage – which was critical for its business model – and ultimately had to file for insolvency.

2. Legal

Disputes, regulatory changes, and compliance failures represent common legal challenges and could result in significant financial and reputational damages. Navigating the legal landscape without the right expertise is, unfortunately, a common pitfall many startups fall into.

Example:

Zenefits, a health insurance startup, faced a legal crisis when it was discovered that the company allowed unlicensed brokers to sell insurance. This led to regulatory investigations and significant fines. The CEO resigned, and the company had to implement strict compliance measures to address the legal issues and rebuild trust with regulators and customers.

3. Operational

Operational crises disrupt day-to-day activities, including supply chain issues, equipment failures, or personnel shortages. Such disruptions can severely impact a startup's ability to deliver products or services on time, leading to customer dissatisfaction and potential loss of business.

Example:

The fitness startup Peloton experienced an during the COVID-19 pandemic. The sudden surge in demand for home fitness equipment led to significant supply chain disruptions. Customers faced lengthy delays in receiving their orders, and the company had to work quickly to scale production and logistics to meet the heightened demand.

4. Reputational

Few things can harm a startup's public image and erode customer trust than a mishandled reputational crisis. Recovery becomes especially difficult in the face of constant negative publicity, customer complaints, and social media backlash.

Example:

Away, the luggage startup, encountered a reputational crisis when a report exposed a toxic work culture, with allegations of harsh management practices and employee mistreatment. The negative publicity forced the CEO to step down, and the company had to take immediate steps to address the cultural issues and restore its reputation.

5. Cyber Threats

Cyber threats, including data breaches and hacking attempts, have doubled since the pandemic. These incidents can lead to the loss of sensitive data, undermine customer trust, and result in hefty financial losses.

Example:

Canva, the graphic design startup, suffered a cyber attack in 2019, where hackers gained access to user data, including email addresses and passwords. The company responded by notifying affected users, implementing additional security measures, and working with cybersecurity experts to prevent future breaches. The incident highlighted the importance of robust cybersecurity practices for startups.

How to Identify the Early Warning Signs of a Crisis

Financial Indicators of a Crisis

Startups should routinely analyze their financial statements and key performance indicators (KPIs) to identify early signs of a financial crisis. Look for patterns like declining revenue growth, rising operational costs, or consistently negative cash flow.

It's also essential to monitor changes in your burn rate and increasing dependency on external funding. For subscription-based models, focus on metrics like customer churn rate and the lifetime value (LTV) to customer acquisition cost (CAC) ratio, as these can uncover hidden financial health issues.

Legal Red Flags to Watch For

Identifying legal risks early involves staying informed about relevant laws and regulations in your industry. To stay within legal bounds, routinely review compliance requirements and conduct internal audits.

Also, watch for signs like receiving warning letters or notices from regulatory bodies, increasing customer disputes, or increasing contract termination notices. Keeping an eye on industry trends and legislative changes can help you anticipate and tackle legal challenges before they knock on the company's doorstep!

Operational Disruptions That Signal Trouble

Early warning signs of operational issues can often be found in performance metrics related to production, supply chain, and service delivery. Implement key operational metrics such as lead time, order fulfillment rates, and defect rates to gain insights into potential bottlenecks.

Frequent supplier delays or quality issues, however, might indicate deeper problems within the supply chain. Employee feedback and incident reports can also highlight underlying operational challenges that must be addressed.

Signs of Reputational Damage

Monitoring your startup's reputation requires active engagement with customers and the public. Use social listening tools to track mentions of your brand across social media platforms and online forums (especially Quora and Reddit).

Analyze trends in customer reviews to identify recurring customer pain points. You should also regularly survey customers to gauge satisfaction levels and quickly address these concerns. Finally, local businesses should monitor the media to catch any potentially damaging stories early.

Detecting Cybersecurity Threats Early

To detect early signs of cybersecurity threats, set up a robust monitoring system for your IT infrastructure. You can do that by:

Using intrusion detection systems (IDS) and security information and event management (SIEM) tools to monitor network traffic for unusual patterns.

Regularly reviewing access logs for unauthorized attempts to access sensitive information.

Training employees to recognize phishing attempts and encourage them to report suspicious activities.

Conducting periodic vulnerability assessments and penetration testing to identify and address potential security weaknesses.

No matter the industry, whether you operate in e-commerce, healthcare, finance, or software, maintaining robust cybersecurity measures is essential. If any of the above points seem overly technical, feel free to contact a cybersecurity expert.

How to Build an Effective Crisis Management Plan

Consider the following step as part of a crisis management checklist.

1. Assemble a Crisis Management Team

Form a dedicated crisis management team that includes experienced members from different departments such as operations, finance, legal, human resources, and communications.

Assign clear roles and responsibilities to each member, ensuring they understand their specific duties during a crisis. This team should routinely meet to stay updated on potential risks and ensure everyone is prepared.

2. Develop Clear Protocols

Create and educate members about the protocols for responding to various crises, including financial, legal, operational, reputational, and cybersecurity threats.

Create step-by-step guides for initial responses, such as who to notify first, how to secure critical assets, and immediate actions to contain the crisis. These must include specific communication strategies for different scenarios and should be accessible to all team members, both in digital and printed formats.

3. Establish Communication Strategies

Effective communication is crucial during a crisis. Develop a comprehensive communication plan that includes:

Internal Communication: Designate spokespersons and establish clear lines of communication to keep employees informed. Use multiple channels such as emails, internal messaging platforms, and meetings.

External Communication: Prepare templates and guidelines for communicating with stakeholders, customers, and the media. To maintain trust and credibility, keep the messaging consistent and transparent. Also, regularly update your website and social media channels with accurate information.

4. Create a Response Plan

Detail the specific steps your team should take when responding to a crisis. This should cover:

Immediate Actions: Secure finances by freezing unnecessary expenditures, assessing financial stability, and securing emergency funding if needed. Address any immediate legal issues, such as compliance breaches or lawsuits.

Short-Term Actions: Implement measures to mitigate the impact, e.g., deploying backup systems or rerouting supply chains.

Long-Term Strategies: Develop a recovery plan that includes rebuilding trust with stakeholders, restoring normal operations, and conducting a post-crisis analysis to identify improvements. Use checklists and timelines to ensure a coordinated and timely response.

5. Conduct Regular Training and Drills

Regularly train your crisis management team and all employees on crisis response procedures. Conduct simulations or drills, preferably twice a year, to test the effectiveness of your plan.

These exercises should mimic real-life scenarios and involve all relevant departments. After each drill, hold a debriefing session to discuss performance, identify weaknesses, and make necessary adjustments to the plan.

6. Monitor and Review

Continuously monitor potential threats by staying informed about industry trends, regulatory changes, and emerging risks. Leverage risk assessment software and conduct routine audits to monitor vulnerabilities.

Review your crisis management plan at least annually or whenever significant changes in your business operations occur. Update the plan based on lessons learned from previous crises, drill feedback, and new risks. Ensure that all team members are aware of and trained on the updated protocols.

Real-life Example of Successful Crisis Management – Southwest Airlines

The COVID-19 pandemic severely impacted the airline industry, leading to widespread travel restrictions, plummeting passenger numbers, and financial uncertainty. Southwest Airlines faced a significant crisis as flights were grounded and revenues plummeted.

The Response:

Proactive Measures: Southwest Airlines quickly implemented health and safety protocols, including enhanced cleaning procedures, mandatory mask policies, and social distancing measures on flights (This corresponds to 'Develop Clear Protocols' as they established detailed procedures to ensure safety.)

Financial Management: The company acted swiftly to manage its finances, securing additional liquidity through loans and stock offerings. Southwest also offered voluntary leave and early retirement packages to reduce payroll expenses without resorting to massive layoffs (This aligns with 'Create a Response Plan,' specifically securing finances and implementing short-term actions to minimize the impact.)

Customer Communication: Southwest maintained transparent and consistent communication with its customers, providing updates on safety measures and flexible travel options. They introduced policies like no change fees and extended travel credits to accommodate changing travel plans (This reflects 'Establish Communication Strategies,' ensuring clear and transparent communication with stakeholders.)

The Outcome:

Southwest Airlines' proactive and customer-centric approach helped them maintain a strong reputation and customer loyalty during the crisis. The airline emerged from the pandemic in a relatively strong financial position compared to many competitors, demonstrating effective crisis management.

Real-life Example of Poor Crisis Management - BP

In 2010, BP faced one of the worst environmental disasters in history when the Deepwater Horizon oil rig exploded, causing a massive oil spill in the Gulf of Mexico. The spill resulted in extensive environmental damage and loss of life.

The Response:

Initial Reaction: BP’s initial response was slow and poorly coordinated. They underestimated the scale of the disaster and struggled to contain the spill (This highlights a failure in 'Develop Clear Protocols,' as there were no effective immediate response actions.)

Communication: BP’s communication was criticized for being inconsistent and insensitive. The CEO's infamous comment, "I'd like my life back," was perceived as out of touch with the gravity of the situation (This shows a lack of 'Establish Communication Strategies,' failing to maintain trust and credibility.)

Accountability: BP was slow to accept full responsibility for the spill, which eroded public trust and intensified criticism (This illustrates poor execution of 'Create a Response Plan,' specifically in addressing immediate legal issues and rebuilding trust with stakeholders.)

The Outcome:

The poor handling of the crisis resulted in severe reputational damage, legal battles, and financial losses exceeding $60 billion in fines and cleanup costs. The incident negatively impacted BP's brand and highlighted the importance of effective crisis management and communication.

Conclusion

Even with the most robust crisis management plan in place, there are moments when the challenges are insurmountable, and a company shutdown becomes the most viable path forward.

Recognizing when it's time to pivot and make tough decisions is crucial for preserving value and safeguarding future opportunities.

If you find yourself in such a dilemma, we’re here to help.

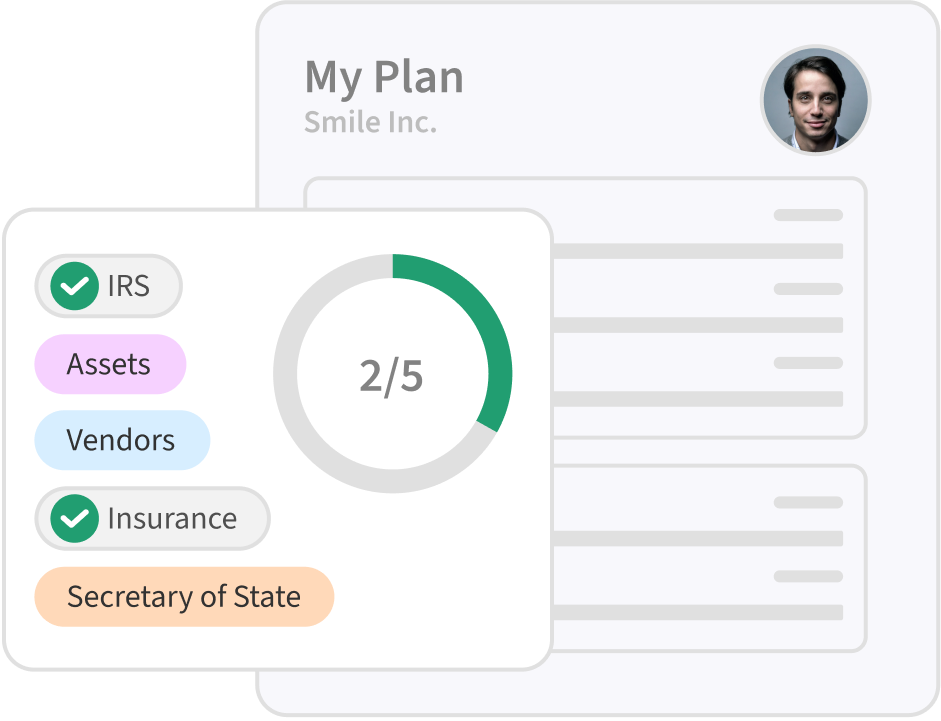

SimpleClosure lets founders shut down their startups by leveraging AI & legal tech. Put simply, we make the company shutdown process faster, easier, and much more affordable than traditional service providers, all done in a legally sound way.