Deciding to close your business is a difficult one, but if you’re certain that is the best path forward, you need to be sure that you carefully and completely follow the dissolution process. Failing to do so can result in liability as well as fees and fines.

The steps you must take to close your business vary depending on your business structure.

Make the Decision

The first step is officially deciding to close your company. If you are a sole proprietorship, the decision is yours alone. If you have a partner or partners, you will have to decide together. If your business is an LLC, you must have a member meeting and a vote, as per your operating agreement.

If your company is a corporation, you’ll need to have a board of directors meeting and hold a vote. If the directors vote to dissolve, a majority of shareholders must also approve the closure. The number of shareholders needed to approve the vote differs by state. You can get state specific help from organizations such as the California Office of the Small Business Advocate (CalOSBA).

Liquidate Assets

Sell your company’s assets, including IP as well as hardware like computers and office furniture. Don’t forget that you may also be able to sell client lists.

Pay Creditors and Employees

Pay all outstanding invoices and all wages. Notify your employees of your plans to close and give them time to look for a new job if possible. Issue final W-2s to all employees.

If you have a 401k, you need to work with an advisor to terminate the plan. You also may need assistance in closing down your employee benefits, including health insurance.

Notify customers, vendors, and creditors and close out all accounts.

File Dissolution Papers with the State

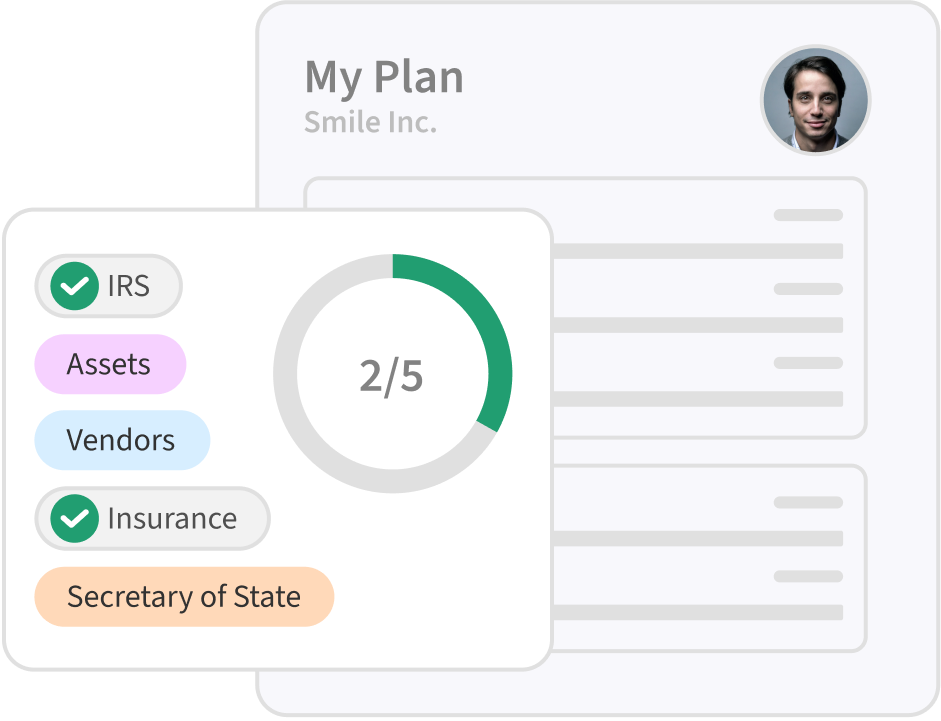

Sole proprietors generally do not need to do this. If you have a partnership you’ll need to draft partnership dissolution papers and file them with the state. An LLC needs to file dissolution papers with the state Secretary of State (for example, the Colorado Secretary of State). A corporation must also file a dissolution certificate with the state Secretary of State or Corporation Agency.

There may be a fee to file your dissolution papers. Check with your state Secretary of State for relevant fees.

Contact the IRS

The next step is to notify the IRS that you are closing your business. You must pay all taxes owed and file a final return. If you are a sole proprietorship, partnership or LLC you will do so through your personal return. A corporation must file its own return. You will obtain a consent to dissolution or tax clearance once you pay all your taxes.

You also must pay any final state taxes and file a final state tax return if needed. The same holds true for sales taxes and employment taxes.

Next, cancel your employer identification number (EIN), which you must do by sending a letter to the IRS.

Close Financial Accounts and Permits

Close any business accounts, credit cards, lines of credit, or other accounts. If your business had to obtain any permits, you must terminate those.

Distribute Cash

After you’ve met all of your obligations and there is cash left, you distribute it to yourself, among partners, among members, or among shareholders.

Maintain Records

Once your business is closed, it is important to maintain records in case of an audit or future lawsuit.

Closing your business requires many steps and attention to detail. We’ve laid out the bare bones of the process, but there are many technicalities and hoops to jump through. SimpleClosure handles all of it for you, ensuring you don’t miss anything and remain completely compliant. Get started today.

FAQs

What are the reasons for the dissolution of a company?

There are many reasons why you might choose to dissolve or close your company. The business may not be profitable, you were unable to raise the money you needed from investors, you didn’t find product market fit, you may be ready to retire, you no longer want to work with your partners, you may have decided to start a new business, you may have been offered a full-time job, and more.

What is the order of dissolution?

To dissolve your company you must file a certificate of dissolution or articles of dissolution with the state where you formed the company. Once this is received your company is dissolved.

What is the difference between liquidation and dissolution of a company?

Liquidation is a sale of the company’s assets. Dissolution is the complete closure of the company. A company going through bankruptcy or assignment for the benefit of creditors may liquidate assets but remain in business. Dissolution ends the company as a legal business entity.