You've built something amazing. Now, it's time to move on. But closing up shop isn't as simple as pulling the plug; there are legal, financial, and administrative hurdles to overcome.

This guide cuts through the red tape, providing a clear, step-by-step process for dissolving your New York corporation. We'll walk you through everything from notifying shareholders to finalizing tax returns so you can focus on your next big venture.

Step 1: Deciding to Shut Down

A corporate dissolution process starts once the board of directors passes a resolution to dissolve. Document the resolution (the intent to dissolve) in the meeting minutes, since you may need to prove the resolution was duly adopted.

Next, you'll need shareholders to approve, typically by a majority vote. However, your corporation's charter, bylaws or investment documents might have additional requirements. Review your formation and investment documents and ensure all necessary steps are followed, including notice to shareholders. Again, the meeting minutes should document the approval.

Step 2: Getting Tax Clearance

Before filing for dissolution, the corporation must receive clearance from the New York State Department of Taxation and Finance. Start by filing your final tax return. Use the form you normally use, but clearly mark it "Final." If the current year's form isn't available, use the previous year's form for a short-period report.

After filing your company’s final tax returns, you must obtain clearance from the New York State Department of Taxation and Finance to verify that you have filed and paid all outstanding taxes. Mail your final return and payment to the address on the tax forms (If you're filing electronically, use approved e-file software).

The Tax Department will review your filings. If everything's in order, they'll issue a written consent to dissolve (Form TR-960). But if there are outstanding taxes or unfiled returns, they'll notify you of what needs to be done before granting consent.

If your corporation operates in New York City with tax liabilities, you'll also need clearance from the Department of Finance. Here's how:

Complete and submit a Request for Consent to Dissolution form to the NYC Department of Finance.

If filing on the corporation's behalf, complete a Power of Attorney form.

Mail both forms to NYC Department of Finance, Collections Division, Quality Management/Special Project, 59 Maiden Lane, 28th Floor, New York, NY 10038.

The NYC Department of Finance will review your request and issue a Dissolution Consent if all tax liabilities are settled. Include this consent with your Certificate of Dissolution when filing with the New York State Secretary of State.

Step 3: Filing the Certificate of Dissolution

After obtaining tax clearances, file the Certificate of Dissolution with the New York Department of State to officially dissolve your corporation. Here’s what you’ll need to include in the Certificate:

Corporation Details: Include the exact legal name, date of incorporation (from your Certificate of Incorporation or amendments), and current officers' and directors' names and addresses.

Authorization Details: Briefly describe how the dissolution was authorized (e.g., board resolution and shareholder vote as discussed earlier).

When filing in the necessary details, keep the following considerations in mind:

Consistency: Ensure the corporation name matches exactly throughout the certificate.

Accuracy: Verify the incorporation date and officer/director information from corporate records or the Department of State's website.

Authorization: Clearly state how the dissolution was approved (vote, resolution).

To submit the Certificate of Dissolution, you'll need to gather a few documents: the written consent from the Tax Department (Form TR-960), the completed Certificate of Dissolution form, and a check for the filing fee made payable to the NYS Department of State. There are three filing options available:

In-person: Deliver all documents to the NYS Department of State, Division of Corporations, located at One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

Mail: Send all documents to the same address listed above.

Fax: Fax the completed Certificate of Dissolution, along with the consent forms and a Credit Card/Debit Card Authorization Form, to (518) 474-1418.

The Department of State will issue a filing receipt upon accepting your Certificate. This receipt confirms that the dissolution has been processed and indicates the official end date of your corporation's existence. Keep this receipt for your records as official documentation of the dissolution date.

Step 4: Fulfilling Legal Requirements

Step number 4 is fulfilling legal requirements, a process that starts by notifying creditors about the company closure, as well as instructions on how to submit claims. Address all valid claims and document these settlements within your records.

Next, avoid future liabilities by canceling business registrations, permits, and licenses. This includes:

Business Names: Cancel any registered "doing business as" (DBA) names.

Permits and Licenses: Contact issuing agencies to cancel relevant permits and licenses.

Tax Registrations: Notify the New York Department of Taxation and Finance and any local tax authorities about the corporation's dissolution.

Issue final paychecks to all employees, including any accrued vacation time and benefits. You must also provide a 90-day notice, but only if you have more than 50 full-time employees, as mandated by the .

Finally, a Discontinuance of Business form (IA 15) must be filed with the New York State Department of Labor to notify them of the closure.

Step 5: Finalizing the Closure

Once you've fulfilled the legal requirements for dissolution, there are a few final steps left that need your attention:

Settle Remaining Obligations: Pay any outstanding bills related to utilities, leases, and service contracts to avoid future liabilities.

Distribute Remaining Assets (if applicable): After settling all debts, if there are any remaining corporate assets, distribute them to shareholders according to your corporation's bylaws and relevant laws.

Close Business Accounts: Once all financial obligations are settled and transactions are complete, close all corporate bank accounts to prevent unauthorized activity.

You must also maintain essential corporate records for a designated period, typically seven years, to comply with potential audits or legal issues. Here's what you should keep:

Certificate of Dissolution

Final Tax Returns

Correspondence with Creditors and Tax Authorities

By following these steps, you can ensure a smooth and complete dissolution of your New York corporation.

Conclusion

This guide provides a framework for understanding the New York startup dissolution process, helping you navigate the shutdown efficiently. But remember, while the guide provides a general framework, it's essential to consult industry experts.

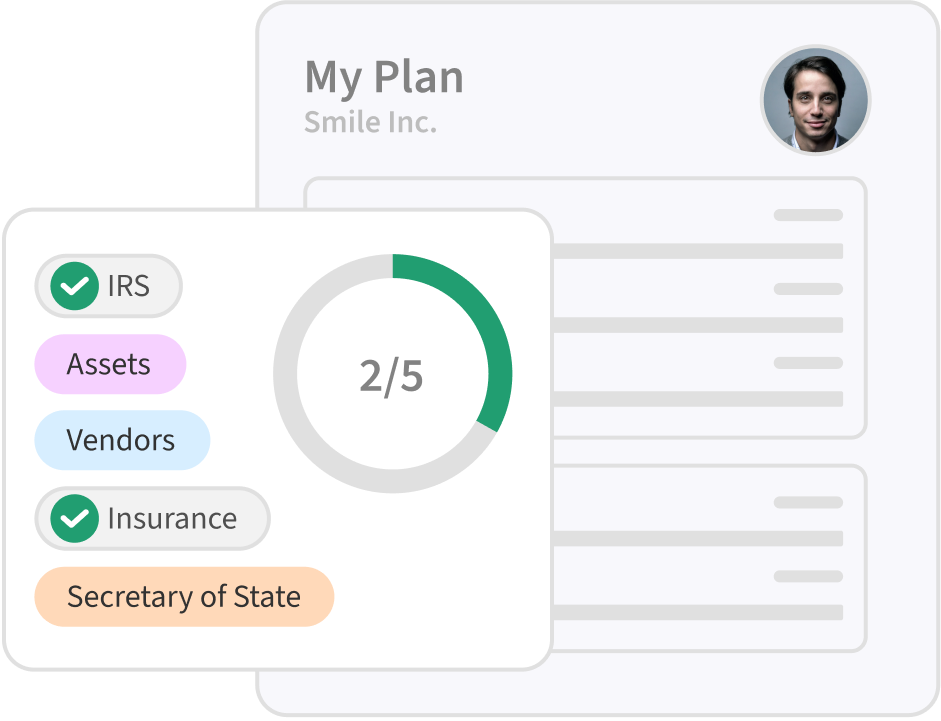

SimpleClosure excels at helping startups shut down in New York. Using AI and having years of industry experience, we can legally end your corporation's existence at affordable rates.

Learn more and schedule a consultation today.