A startup shutdown isn't the end of the world, especially when you consider that 9 out of 10 startups never make it past the first year.

That’s not to glamorize failure but to put things into perspective. In fact, many successful entrepreneurs have experienced setbacks and used them as valuable learning experiences, and you can do the same.

This article equips you with the knowledge and resources you need to navigate a startup shutdown. It provides a roadmap with additional reading material for each step.

When to Shut Down Your Startup?

Understanding when to shut down your startup can be challenging, especially when you've invested so much time, effort, and resources into it. While making this decision is tough, recognizing the signs early can save you time, money, and heartache.

One of the clearest indicators is financial instability, i.e., your startup consistently struggles to meet financial obligations despite numerous attempts to pivot or secure additional funding. Business viability goes out the window when you burn more cash than you generate.

Another key factor is lack of market demand, that is, a persistent lack of interest in your product or service despite serious marketing efforts. Sometimes, even with a groundbreaking idea, the market might not be ready or interested.

The third major sign is operational challenges. These include issues like an ineffective business model, difficulty scale, or persistent legal and compliance challenges that make it nearly impossible to continue.

Further reading: Here are 5 tell-tale signs that, if present, indicate that now is the best time to close your startup business.

Dissolving Your Startup: Essential Administrative Steps

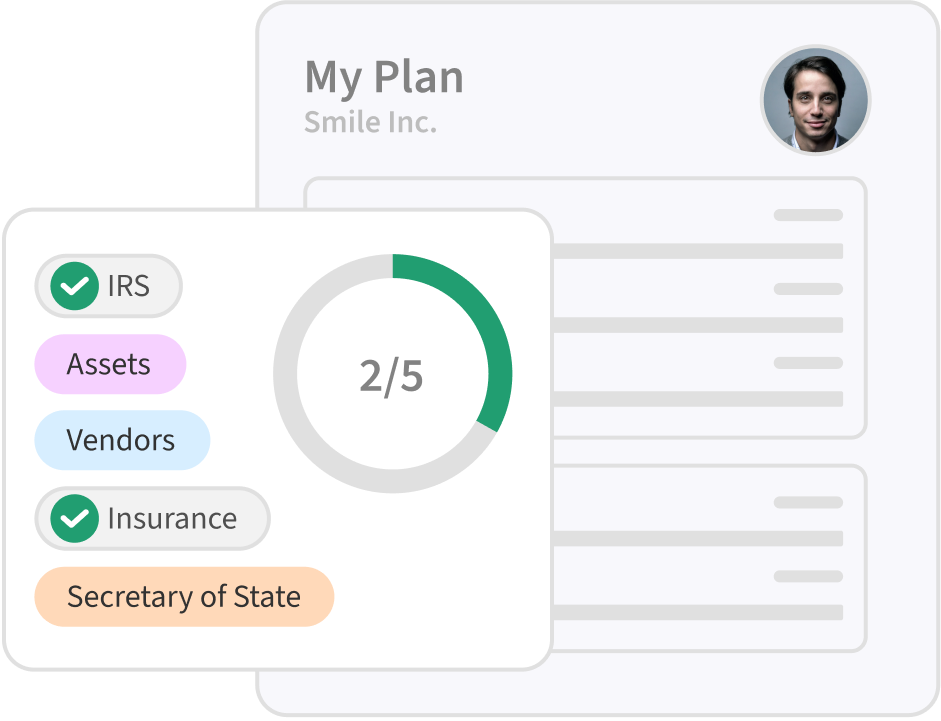

Dissolving your startup is more than just closing the doors. It requires careful attention to administrative tasks to properly shut down your business and avoid future complications. Here's a simplified guide to help you navigate this process:

Inform the Authorities: Let the IRS know you're closing by filing the necessary forms and settling any outstanding taxes. Similarly, close your state tax accounts. Depending on your business, you may need to inform other regulatory bodies as well.

Cancel Registrations and Permits: Cancel your Employer Identification Number (EIN) with the IRS and file dissolution documents with your state. Remember to also cancel any business licenses or permits.

Handle Contracts and Agreements: Carefully review contracts with vendors, suppliers, customers, and employees. Follow the proper procedures for terminating each, ensuring you fulfill any remaining obligations.

Address Intellectual Property: Identify and document your trademarks, patents, copyrights, and trade secrets. Determine ownership and decide whether to transfer, sell, or abandon these assets. Protect your intellectual property throughout the process.

Employee Termination: If you have employees, comply with all labor laws when terminating their employment. Provide proper notice, final paychecks, and information about severance and benefits.

Further reading: Here’s a comprehensive blog highlighting how to dissolve an S corporation in every state

Handling Financial Matters

Properly managing finances is necessary during a startup shutdown. Here's what to prioritize:

1. Settling debts:

Prioritize paying all outstanding debts, including creditors, employees (final paychecks, severance, benefits), and investors (return any remaining capital).

If you find yourself unable to pay all your debts, communicate transparently with creditors and investors and inform them about your situation. Then, negotiate payment terms to fulfill obligations while conserving as much funds as possible.

2. Liquidating assets when closing a startup:

Start by cataloging all business assets (inventory, furniture, intellectual property). Next, maximize the sale of these assets by seeking fair offers through online marketplaces, auctions, or direct sales.

3. Issuing the final payroll and severance:

Issue final payrolls to all employees, including final paychecks, severance, and accrued benefits. This process should be transparent to ensure that employees understand their final compensation.

Further reading: The tax implications of a startup company shutdown are numerous, complex, and beyond the scope of this blog.

The Mental Health Side of Things

Closing a startup involves opening a complex and mixed bag of emotions. From grieving the loss of a dream and the impact on colleagues to feeling the sting of disappointment from unmet expectations, the emotional toll is significant. The pressure of winding down operations and the uncertainty about the future further add to the stress and anxiety.

While the journey is personal and no two experiences are alike, consider the following tips:

Acknowledge your feelings: Don't suppress emotions. Talk to a therapist or trusted friend, and allow yourself to grieve, feel angry, or frustrated.

Seek support: Surround yourself with a network of understanding individuals who can offer support and guidance.

Maintain perspective: Remember, a shutdown is a learning experience. Celebrate the achievements of your startup and use it to build resilience.

Focus on the future: Take time to reassess your goals and explore new opportunities. Leverage your experience for future ventures.

There are plenty of options available to help you through this challenging time. For instance, mental health professionals experienced with entrepreneurs can offer valuable guidance. Also, with a bit of research, you can find startup support groups and reach out to others who've faced similar challenges for specific support and advice.

Further reading: We’ve delved into each point in greater detail in this blog on how to recover from startup failure and come back stronger.

Staying on Investors’ Good Side

Even though the outcome wasn't what you hoped for, maintaining trust with your investors is important for your reputation and future endeavors. Here's how to safeguard your reputation and build bridges for the future:

It pays to be honest: Much of a founder’s reputation is built on trust. Be upfront about the reasons for shutting down and your plans for the future. Doing so shows integrity and increases the chances of investors doing business with you again in the future.

Keep investors in the loop: Regular updates with clear explanations help investors understand the challenges you face. Detailed information is key to preventing misunderstandings.

Don't forget your team and customers: Hold meetings or send updates to employees and customers. Show them you value their involvement and appreciate their contributions.

Public perception matters: Craft a clear message explaining the closure and next steps. This transparency controls the narrative and maintains your credibility. If there's an acquirer, clarify the transition plan and how it benefits stakeholders.

Further reading: Preserving your reputation post-startup shutdown is a skill, one that you can acquire by going through this startup company reputation management guide.

Finalizing the Shutdown

The final stages of shutting down your startup require meticulous attention to detail. Here's a roadmap to ensure a smooth and professional closure:

Gather and Organize Documentation: Begin by compiling all essential legal, financial, and operational records, including contracts, tax documents, employee files, and intellectual property information. Having these documents readily available will be crucial for the next steps.

Consult with Experienced Professionals: Closing a business involves navigating complex legal, tax, and financial considerations. Seek guidance from experienced advisors who can help you understand requirements, assess potential liabilities, and ensure compliance, minimizing risks and streamlining the process. SimpleClosure specializes in startup dissolution and has the expertise to guide you through every step.

Address Outstanding Tasks: Tie up loose ends responsibly. This includes final tax filings, vendor payments, and secure and compliant customer data management. Completing these tasks diligently demonstrates professionalism and safeguards your reputation within the business community.

Get your free founder's guide to shutting down

A comprehensive breakdown of how founders can quickly and easily execute a fully compliant shutdown