Shutting down a fintech startup? It’s a complex process that requires more than just shutting off the servers. You need to get approval from the board, protect sensitive data, and settle financial obligations—all while maintaining compliance with regulatory bodies.

Don’t worry; here’s a step-by-step guide for a seamless and legally compliant startup dissolution.

Step #1: Getting the Board of Directors on Board!

Even if you (i.e. the founder) think shutting down your startup company is the best course forward, you’ll need input from various stakeholders, including the board of directors, investors, and management team.

Suppose the decision to proceed with a shutdown is made. In that case, the board of directors convenes a formal meeting to discuss the matter in detail (potential alternatives like mergers, acquisitions, or strategic pivots could also be explored). Given their significant stake in the company, investor input is crucial during this stage.

A formal vote on the shutdown decision is usually required, but the specific voting requirements depend on the company's bylaws. Document this decision and all related discussions in meeting minutes, which should include the following details:

Date, Time, and Venue: Note the meeting's date, time, and location (or virtual platform).

Attendees: List the names of all present board members, absentees, and invited advisors.

Agenda Items: Summarize the key agenda items, focusing on the shutdown decision.

Discussions and Deliberations: Provide a brief overview of discussions, including key concerns and alternative options considered.

Decisions Made: Record the decision to shut down, citing reasons such as financial assessments and regulatory risks.

Votes: Document the vote, noting whether it was unanimous or passed by a specific margin.

Action Items: Outline the specific actions to be taken, including assigned responsibilities and timelines.

Inform Relevant Government Institutions

Given the complex fintech regulatory environment, it is paramount to inform relevant financial regulatory authorities about the shutdown. These include the Consumer Financial Protection Bureau (CFPB), Securities and Exchange Commission (SEC), and state banking or insurance departments.

But that’s not all – the exact notification and compliance procedures vary depending on the fintech company's business model and the jurisdictions in which it operates. The table below outlines the specific regulatory considerations for different fintech business models:

Fintech Model | Compliance & Regulatory Considerations |

Payment Processors and Digital Wallets | Regulatory Compliance: Extra scrutiny from payment networks (e.g., Visa, MasterCard) and financial regulatory bodies (CFPB, OCC, FDIC). Customer Funds: Safely process and transfer all customer funds. Data Security: Manage sensitive payment information and ensure PCI DSS compliance. |

Peer-to-Peer Lending Platforms | Loan Servicing: Arrange for ongoing loan servicing and transfer of loans to another servicer. Investor Communication: Communicate with borrowers and lenders regarding the status of loans and investments. Regulatory Requirements: Ensure compliance with state and federal lending regulations (CFPB, OCC, state lending authorities). |

Robo-Advisors and Investment Platforms | Asset Liquidation: Process the liquidation and transfer of client investments. Client Accounts: Handle client accounts, including any regulatory obligations for notifications and transfers. Securities Regulations: Adhere to SEC and FINRA regulations throughout the shutdown process. |

Insurtech Companies | Policy Management: Transition or terminate existing insurance policies. Customer Claims: Ensure all outstanding claims are processed and paid out. Regulatory Notifications: Inform state insurance regulators and ensure compliance with insurance laws. |

Cryptocurrency Exchanges | Asset Custody: Securely transfer or return customer crypto assets. Regulatory Compliance: Address both federal and state regulatory requirements, including those from the SEC and FinCEN. Security Measures: Maintain robust security during the wind-down period to prevent hacks or fraud. |

Personal Finance and Budgeting Apps | Data Handling: Securely delete or transfer user data. Subscription Refunds: Handle refunds for any prepaid subscription fees. User Notifications: Clearly communicate with users about the shutdown and data handling procedures. |

Note: Fintech startups operate in many areas of finance, including cryptocurrency and blockchain, which adds a new layer of complexity when it comes to compliance and regulation. If your fintech company operates within this space then don’t forget to check out this crypto startup shutdown guide as well.

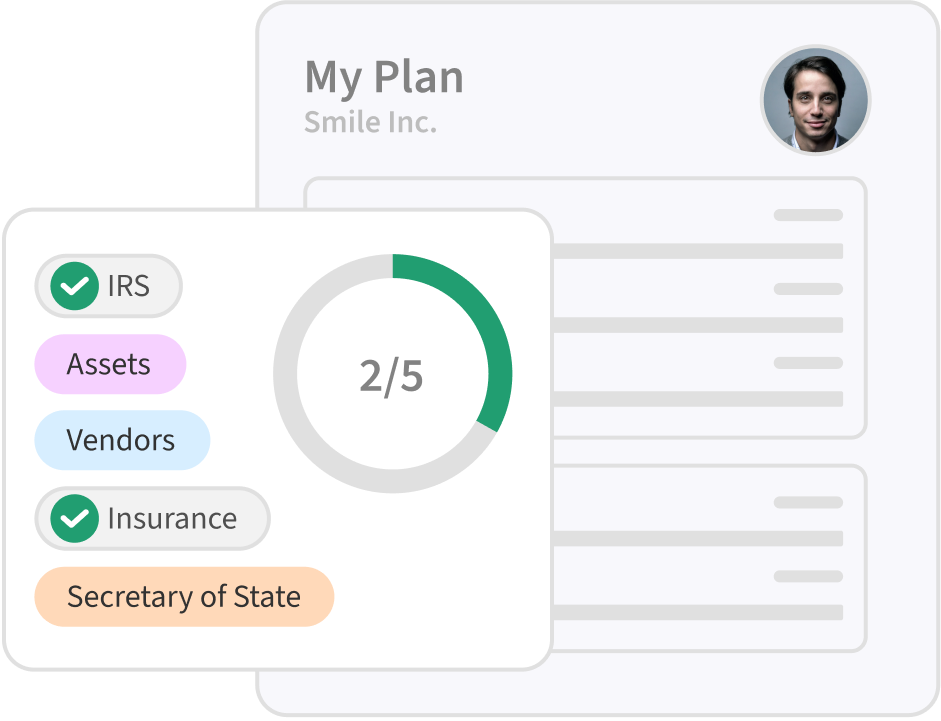

Step #2: Following the Correct Legal Procedures

Submit a Certificate of Dissolution with the Secretary of State’s office in the state where your fintech is incorporated. If your fintech operates across multiple states or countries, ensure that dissolution filings are completed in each relevant jurisdiction (and also notify federal regulators if required).

You must cancel or surrender all relevant licenses and permits, such as money transmitter licenses, lending licenses, or securities licenses. This process may include submitting formal notices, paying outstanding fees, and filing final reports.

The last requirement in this step is to complete your final tax filings, including federal, state, and possibly local tax returns. Settle all outstanding tax obligations like back taxes, penalties, or accrued interest to avoid further penalties. Pay special attention to any tax obligations arising from asset sales or shareholders distributions.

Step #3: Letting the World Know

Start With Your Employees

After informing the higher-ups and regulatory bodies, it’s time to bring your employees up to speed. Some of these people have access to and handle sensitive information, so it’s essential to clarify their roles and responsibilities during the windup process.

Provide updates regarding severance and benefits (if any) and outplacement services if you can. Again, stress the importance of maintaining data and system security and the possible legal consequences of mishandling sensitive information.

Inform Your Customers

Then, announce the news to your customers along with step-by-step instructions on how they can close their accounts, withdraw funds, or transfer assets to another provider. Communicate the news through multiple channels, such as social media accounts, in-app notifications, announcing on your official website, and sending emails.

Next, you should transfer, encrypt, or permanently destroy sensitive data according to data protection laws (e.g., GDPR, CCPA) and keep customers in the loop on how you handle their data. Doing so builds trust and reduces the likelihood of legal challenges post-shutdown.

Step #4: Settling Remaining Financial Matters

The next step in ensuring a smooth and compliant startup shutdown is to settle the remaining financial matters.

Settle Debts and Obligations

Compile a list of all creditors, vendors, and financial institutions that must be paid. Although regulatory bodies could require which party must get paid first – especially if customer funds are involved – the general rule is to pay off secured creditors first, then unsecured creditors, and then equity holders. Be transparent and upfront when engaging with creditors and vendors to negotiate favorable terms.

If any assets - including cash reserves, intellectual property (e.g., proprietary algorithms, software) - remain after settling debts, you should distribute the proceeds from sales in accordance with the company's bylaws or shareholder agreements.

Step #5: Moving On

A fintech startup dissolution brings with it all kinds of emotions - disappointment, frustration, and stress! And although it's a challenging process, partnering up with the right people who can help you navigate through it efficiently can take a massive load off your shoulders.

SimpleClosure has helped many fintech startups like yourself shut down compliantly – and that’s not all. We leverage the latest AI and legal tech to significantly reduce the time and the money it takes to shut down your business.

Ready to move ahead? Let’s talk.