“A startup founder’s responsibility ends once their company dissolves,” is one of the biggest misconceptions surrounding the dissolution process.

Even after your startup dissolves on paper, there could be few issues you’d need to resolve to settle legal and financial affairs for good.

In this post-dissolution best practices guide for startups, you’ll learn how to fulfill your obligations and safely move on to the next chapter of your career.

Why Should You Care About Post-Dissolution Best Practices?

Properly addressing post-dissolution tasks is critical for startup founders shutting down their companies. This helps minimize legal risks, finalize financial obligations, protect intellectual property, ensure proper data handling, and maintain records in case of audits or disputes after the business is closed.

Note: This blog focuses on the essential steps startup founders should take after dissolving their business. If you’ve yet to reach this point, go through our startup dissolution checklist blog before proceeding any further.

Post-Dissolution Best Practices: A Checklist

The following is a concise checklist to guide you through the essential post-dissolution tasks:

1. Monitor and Address Residual Legal Claims

Look for any legal claims or disputes that might arise after the shutdown. Stay vigilant for new claims and be ready to respond appropriately. For example, if a former contractor files a lawsuit claiming unpaid invoices, gather all relevant documentation to address the claim efficiently.

2. Follow Court Orders

Follow any court orders or legal settlements that extend beyond the dissolution date. Ensure all obligations under these orders are met to prevent legal and financial penalties. For example, if the court orders you to continue health benefits for certain employees six months post-dissolution, provide these benefits and document the process.

3. Handle Final Financial Obligations to Employees

Complete all final financial obligations to employees. This includes paying unpaid wages, accrued vacation, and severance pay. Also, comply with any benefits continuation requirements, such as COBRA. For instance, if your startup promised an employee severance pay, process this payment and communicate clearly about their COBRA health insurance options.

4. Maintain IP

If your startup holds intellectual property, keep patents, trademarks, and copyrights updated or transfer them appropriately. This could involve paying renewal fees or finalizing licensing agreements. For example, if you hold a patent, pay the renewal fee to keep it active or transfer it to another entity if you no longer need it.

5. Comply with Data Privacy Laws

Adhere to data privacy laws when disposing of or transferring customer and business data. Also, conduct data audits, anonymize data if necessary, and securely destroy any no longer needed data. For instance, use a certified data destruction service to securely destroy old customer records no longer required for business operations.

What Type of Records and Documents Should You Maintain?

Tax Records: Includes tax returns, supporting documents, and correspondence with tax authorities.

Financial Statements: Balance sheets, income statements, cash flow statements, and other financial documents.

Corporate Minutes and Resolutions: Records of board meetings, shareholder meetings, and significant corporate decisions.

Employment Records: Payroll records, employee contracts, benefits records, and termination documentation.

Legal Documents: Contracts, agreements, intellectual property documents, and any litigation-related records.

Bank Records: Bank statements, canceled checks, and deposit records.

Licenses and Permits: Copies of any business licenses and permits.

How Long You Should Retain Each Type

Tax Records: The IRS recommends keeping tax records for at least seven years.

Financial Statements: General business practices and IRS guidelines suggest keeping financial records for at least seven years.

Corporate Minutes and Resolutions: Corporate governance best practices recommend keeping these records permanently.

Employment Records: Federal guidelines state that employment tax records should also be retained for at least four years after the tax payment or due date. However, state-specific requirements can vary. For example, the retention period in California is three years, but in New York, it’s six years.

Legal Documents: Best practices and some state laws recommend keeping contracts and agreements for at least seven years after expiration.

Bank Records: IRS guidelines suggest keeping bank records for at least seven years.

Licenses and Permits: Local requirements could vary, but generally, these should be kept for three to seven years after expiration.

Conclusion

This guide has covered crucial post-shutdown tasks for startup founders to minimize risks and fulfill their responsibilities. While we've kept the information straightforward, properly handling these matters can be complex. Getting expert help is often advisable to ensure you're meeting all obligations.

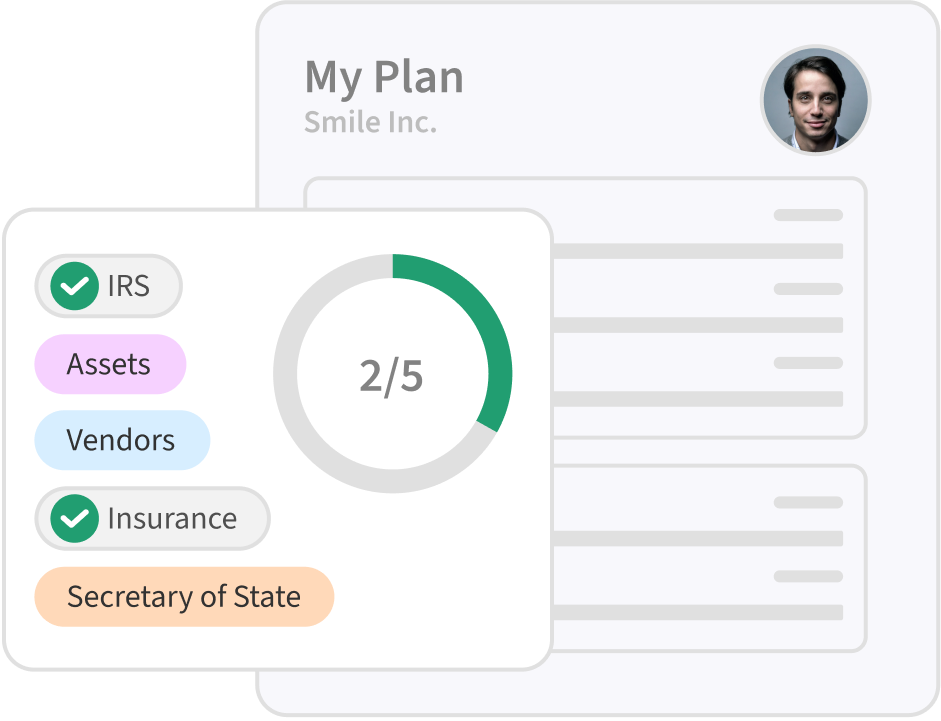

At SimpleClosure, we make the startup dissolution process easy; you fill in a few details, we have a nice little conversation, and the dissolution process officially begins.

Ready to simplify your shutdown? Contact us today!