You’ve heard it before: most startups fail. Indeed, the statistics are stark: 93% of startups ultimately shut down, with many entering dissolution within the first few years. This is during normal times. The past few years of venture capital have been anything but normal.

With interest rates historically low, 2021 saw a rash of investments from VCs, who recognized the potential in technology-driven solutions to new challenges, fueling an unprecedented surge in startup funding, especially in tech, healthcare, remote work, e-commerce, and digital transformation sectors.

This environment created a wave of funding that helped many startups scale rapidly. However, the rapid capital infusion sometimes encouraged high burn rates and growth-at-all-costs mentalities, leading to sustainability challenges as markets shifted post-pandemic.

In recent years, many high-profile companies ceased operations despite significant funding and early promise. It was in this environment that SimpleClosure was created, seeking to automate and simplify the arcane and manual shut down process.

In order to gain a better understanding of the state of startup closures, we took a look at our data to find which startup stages were seeing the highest rates of closure, average length of startup age, investment lost, and more.

Let’s dig in.

Average stage of shutdown

The vast majority of shutdowns — 78% — have been in the tech industry (such as software or financial services/fintech). Seventy-one percent of all shutdowns since 2023 are either pre-seed or seed, with the plurality (41%) at the seed stage, while 8% have reached Series A or higher.

Last raise

Nearly half (48%) of startups that have shut down secured their last raise in 2022, with a quarter (26%) in 2023.

Investment lost

Most companies go to shutdown (regardless of stage) when they have, on average, ~$265K left. Pre-seed & Seed companies are relatively the most financially healthy when they go to shut down and have at least 10% of their cash left. Series A and beyond "drive companies to the ground" with insufficient capital left to distribute money back to investors and pay creditors. It's almost as if they are a lot more "go big or go home" compared to seed and pre-seed companies:

Capital returned

The majority of startups (60%) that fail don’t have enough capital left to return to investors. Founders that do plan on returning funds have an average $630K of investments left — about 10% of total capital raised, on average.

Shutdowns by location

San Francisco and New York tie in, representing the cities with the largest share of startup shutdowns.

Conclusion

With the rate of startup closures increasing, the predictions of tech zombies and a startup graveyard have continued to make headlines. Despite the crop of new investments, there are a lot of companies that have raised at high valuations and without enough revenue.

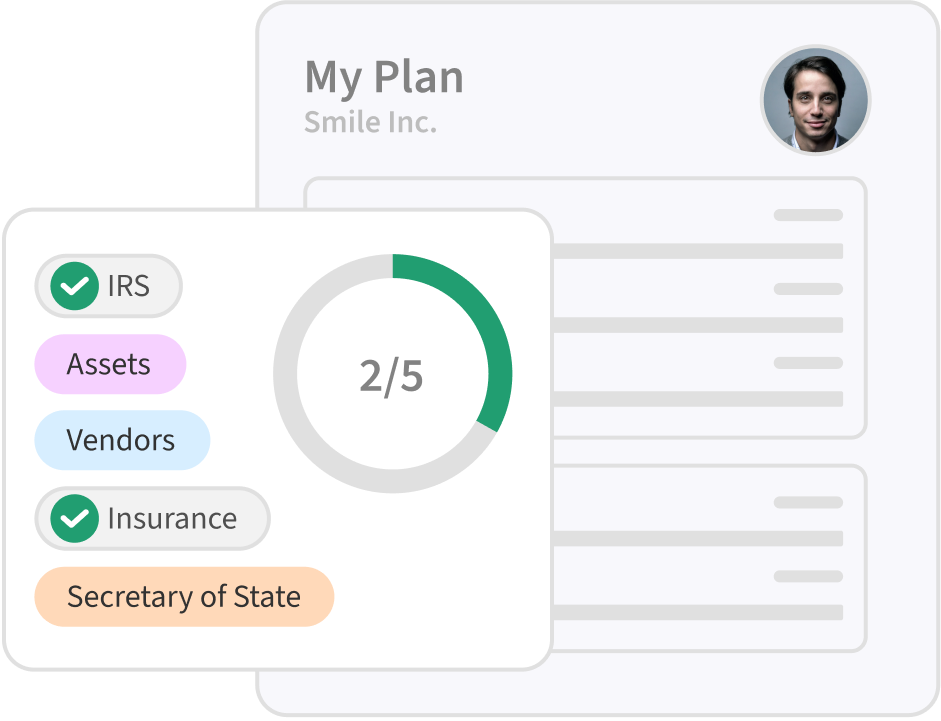

SimpleClosure partners with leading VCs and law firms to reduce the complexity, cost, and time of startup dissolution. Our expert team handles everything from asset distribution to regulatory filings, helping you:

Save 80% on shutdown costs

Complete dissolutions in weeks, not months

Return remaining capital to investors efficiently

Maintain compliance throughout the process

Join the growing network of VCs and law firms using SimpleClosure. Contact partners@simpleclosure.com to learn more about our partnership program.