Closing a company is complex, and missing the details can lead to big problems. Whether you’re choosing to end your business or external circumstances are forcing your hand, it’s important to know what you’re facing.

This blog breaks down two scenarios: voluntary dissolution, where business owners decide to close, and involuntary dissolution, caused by outside forces. Read on to know how you can avoid these common pitfalls.

Key Takeaways

There are two types of dissolution: voluntary and involuntary. Within involuntary, there are administrative and judicial dissolutions.

How a company dissolves depends mainly on its business structure. However, the process becomes increasingly complex as you add more owners and assets.

Improper company dissolution could make you personally liable even after your company ceases to exist.

What is Voluntary Dissolution of a Company?

Voluntary dissolution is when the company owner(s) decide to shut the business down or, in other words, legally end its existence. It starts with the approval from the owners/partners/board of directors, followed by filing the articles of dissolution, liquidating assets, paying debts and taxes, and finally, distributing what’s left among the owners.

Generally speaking, sole proprietorships are the easiest to shut down, whereas corporations are the most complex.

The following section explains how voluntary dissolution happens based on the business structure.

Voluntary Dissolution of a Sole Proprietorship

Winding down a sole proprietorship or a business run by one person is relatively straightforward. The owner:

Stops managing company operations

Closes their business accounts

Cancels their business permits and licenses (if any)

Settles outstanding debts

Pays their taxes and notifies the IRS

Claims remaining assets as their own.

The owner must resolve any remaining liability because, under US law, a sole proprietorship and its owner are considered one entity.

Voluntary Dissolution of a Partnership

The dissolution of a business partnership commences after all founders agree to shut the company down. The exact steps are usually outlined in the partnership agreement, but if no such terms were penned during company formation, then state laws for dissolution must be followed.

Partnership dissolution is similar to sole proprietorship, but because there are two or more than two owners, the remaining company assets are distributed according to each partner’s ownership interest in the company.

Voluntary Dissolution of a Limited Company

A voluntary dissolution of an LLC takes place after all the owners unanimously agree to terminate the company. Like the partnership business model, LLCs have what’s called an operating agreement, which usually specifies how the shutdown process is carried out. If an operating agreement doesn’t exist, then the default state laws for LLC dissolution apply.

Note: Sometimes, the founders voluntarily dissolve their business to pursue opportunities in other markets or avoid filing for bankruptcy.

Voluntary Dissolution of a Corporation

Corporations are complex business entities, so the voluntary dissolution process has many steps and takes longer to complete. It starts when the board of directors passes a resolution recommending dissolution, which is then presented to the shareholders to vote on.

Once the resolution is approved, the corporation must file articles of dissolution in the state where the company is registered, followed by the usual winding up protocols associated with business closure. However, there are additional tax considerations for S and C-Corporations.

S-corporations are pass-through entities, meaning the company’s income, losses, credit, and deductions are reported on shareholders’ individual tax returns. On the other hand, C-Corporations are taxed ‘twice,’ once on their income and second on the dividend proceeds given to the shareholders.

Note: Want to learn more about taxation? Go through our blog on the tax implications of closing a startup.

What is Involuntary Dissolution?

Involuntary dissolution is the legal termination of a company by a third party. It can occur due to several reasons, like not complying with state or federal laws, engaging in illegal activity, or being unable to settle outstanding debts. Involuntary dissolution can be initiated by a creditor, shareholder, or the government.

Under the umbrella of involuntary dissolution are administrative and judicial dissolution.

Administrative dissolution is carried out by the state (and not a court) when a company fails to pay its taxes, maintain a registered agent, or doesn’t file its annual reports. The state issues a notice warning to the company of the imminent dissolution if it doesn’t take corrective action.

Judicial dissolution is initiated by a shareholder rather than a court or creditor. It’s the least common type of dissolution and is usually used as a last resort when there are internal disputes among the owners and shareholders.

Now, let’s explore some reasons behind the involuntary dissolution of companies based on different business structures.

Involuntary Dissolution of a Sole Proprietor

A sole proprietorship could involuntarily dissolve due to the owner's death or inability to operate the business any longer. In other cases, a court-ordered dissolution could be on the cards if the company – and, by extension, the owner – could not pay their taxes or is engaged in illegal activity.

Involuntary Dissolution of a Partnership

Reasons for the involuntary dissolution of a partnership are similar to a sole proprietorship (i.e., insolvency and illegal activities), with the added possibility of dispute or violation of one or more terms contained within the partnership agreement.

Involuntary Dissolution of an LLC

An LLC can face involuntary dissolution for reasons similar to partnerships and other legal issues like failing to comply with state regulations, not filing required reports, internal conflict of interests, ignoring protocols contained within the operating agreement, abandonment of business operations, and a few other reasons.

Involuntary Dissolution of a Corporation

C and S-corporation involuntary dissolution are more complicated than the rest, mainly because of the tax implications associated with the shutdown. The reasons behind an involuntary shutdown are similar to LLCs, with the added possibility of loss of key personnel and internal mismanagement and fraud.

What Are Some of the Effects of Involuntary Dissolution?

The overall process of winding down a company voluntarily or involuntarily has many similarities. However, there are two main differences: First, voluntary dissolution is just that – the company closure is done willingly, whereas an involuntary dissolution is enforced upon the company.

Secondly, involuntary dissolution can result in negative legal and financial consequences for founders, some of which include:

Personal liability for debts, especially for sole proprietorships, partnerships, and, in some cases, even LLCs.

A loss of business licenses and permits.

Personal credit scores take a hit

Unexpected tax liabilities

Potential lawsuits from shareholders

High attorney and lawyer fees

Conclusion

Company dissolution, voluntary or involuntary, is an unfortunate event and takes a financial and mental toll on the founders. Having read this far, you’re probably aware of how overly complicated the entire ordeal can be.

But as with most overcomplicated things, there’s always an easier route.

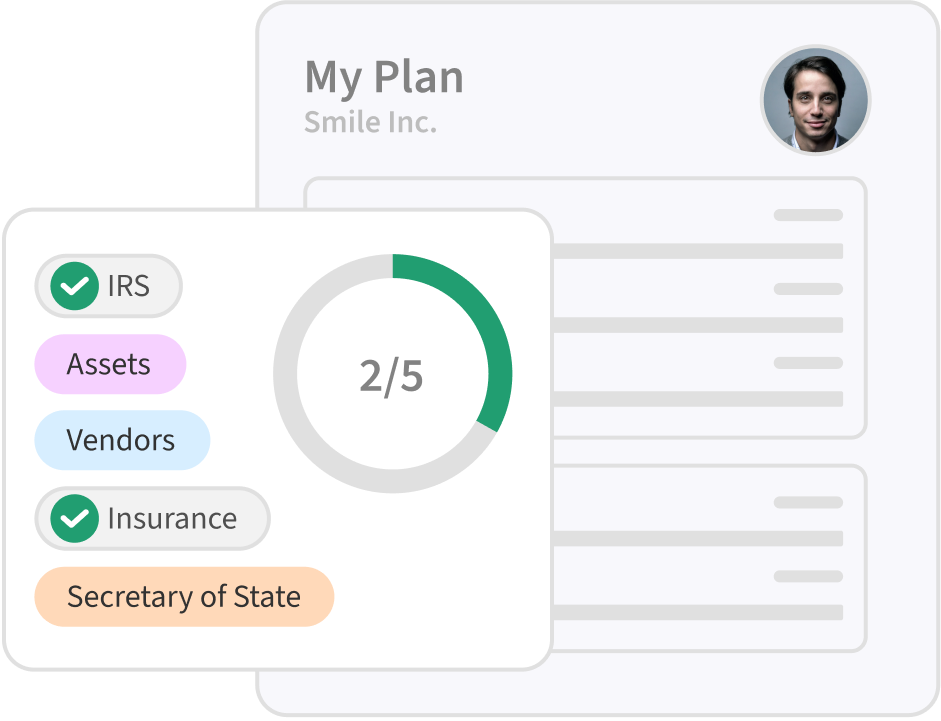

Here at SimpleClosure, we leverage legal tech, fintech, and AI to assist company founders in legally closing their businesses without burning a hole in their wallets.

It’s fast and economical; we’re talking about reducing processes that take months to more than a year down to weeks while potentially saving you tens of thousands of dollars in legal fees!

Ready to wind up operations peacefully? Let’s get talking.

FAQs

What Comes First, Dissolution or Liquidation?

Generally speaking, dissolution takes place before liquidation. After company owners decide to shut the business down, the process of liquidating assets to pay creditors begins.

Can a Dissolved Company Be Held Liable?

Yes, a dissolved company can still be held liable for things like unpaid debts, outstanding lawsuits, and unresolved tax liabilities. The specifics vary from one state to another.

Who Has to Bear Dissolution Expense at the Time of Dissolution of a Firm?

The dissolution expense is borne by the company itself, i.e., from the funds gathered by selling remaining assets. If the funds are insufficient to cover the dissolution expense, then sole proprietorship and partnership owners must pay it out of their pockets. The same could be the case for LLCs and Corporations.